The accounting staff of dental practices may encounter several unusual or unexpected problems that they might not always be fully prepared for, given the unique nature of dental billing and practice management. Some of these include:

1. Complicated Insurance Reimbursements:

Dental insurance often has complex reimbursement structures with specific limitations on procedures, frequency of treatments, and maximum coverage amounts.

For instance, a patient might come in for a crown, expecting their insurance to cover most of the cost. However, the insurance may only cover 50% of the procedure, or the patient may have already maxed out their annual benefit limit. Navigating these intricacies can lead to unexpected delays and denials, which can be frustrating and time-consuming for both patients ans accounting staff.

2. Handling Capitation Plans:

Some dental practices may participate in capitation plans, where they receive a fixed amount per patient from an insurance company regardless of the services provided.

For example, if the practice receives $20 per month for each patient covered under the plan, but several patients require costly treatments like root canals or dentures, the practice may struggle to cover its costs. This can create challenges in managing cash flow and ensuring profitability, particularly if the practice experiences higher-than-expected patient visits or procedures that are costly to perform.

3. High Volume of Small Transactions:

Dental practices often deal with a high volume of small transactions, especially when patients pay out-of-pocket for co-pays, deductibles, or non-covered services.

For example, a patient might pay $10 for a fluoride treatment and $30 for a cleaning. This can lead to challenges in tracking and reconciling payments, particularly if the accounting staff is not accustomed to handling such a high volume of low-dollar transactions.

4. Frequent Patient Disputes Over Billing:

Patients often have misunderstandings about what their dental insurance covers versus what they are responsible for paying.

For instance, a patient may receive a bill for a filling and argue that it should have been covered fully by their insurance. This can lead to frequent disputes or requests for payment plans, requiring the accounting staff to spend significant time explaining charges, correcting billing errors, and managing patient expectations.

5. Seasonality of Revenue:

Dental practices often experience fluctuations in patient visits and revenue based on the time of year.

For example, there may be an increase in visits at the end of the year as patients try to use up their insurance benefits before they expire. On the flip side, summer months may see a dip in appointments due to vacations. This seasonality can create challenges in budgeting and cash flow management that the accounting staff may not anticipate.

6. Coordination of Benefits (COB) Issues:

When patients have dual dental coverage (e.g., through two different insurance policies), coordinating benefits can be complicated.

For example, if a patient has both a primary and secondary insurance, the accounting staff must determine which plan pays first and how much. Incorrect coordination could result in underpayments or delays, making it difficult to maximize reimbursements while avoiding overcharges.

7. Unanticipated Write-Offs:

Dentists may have to write off certain charges unexpectedly due to various reasons, such as insurance not covering as much as anticipated, incorrect coding, or goodwill adjustments for patients.

For instance, if a claim is denied because the treatment was not pre-authorized, the practice might have to absorb the cost, affecting revenue and complicating the accounting staff’s ability to forecast financial performance accurately.

8. Complex Fee Schedules:

Dental practices often have multiple fee schedules based on different insurance contracts, discounts for cash payments, and special rates for certain groups (e.g., employees, family members).

For example, a practice might charge $150 for a cleaning for cash-paying patients but only $90 for patients with a particular insurance plan. Managing and applying these fee schedules accurately can be difficult, particularly if the practice deals with a wide range of insurance providers and plan types.

9. Sudden Changes in Insurance Policies:

Insurance companies may change their coverage policies, fee schedules, or claim processing procedures with little notice.

For example, an insurance company might suddenly decide to lower the reimbursement rate for a common procedure like a filling, or require additional documentation for claims. These changes can lead to unexpected billing challenges, delays in payments, or adjustments to previously submitted claims that the accounting staff must quickly adapt to.

10. Increased Regulatory Scrutiny:

Dental practices, like other healthcare providers, are subject to increasing regulatory scrutiny, particularly concerning billing practices.

For instance, if a practice is found to be incorrectly coding procedures to receive higher reimbursements, they could face fines or audits. Accounting staff may find themselves dealing with unexpected audits, compliance reviews, or the need to implement new procedures to comply with evolving regulations, such as those related to patient privacy (HIPAA) or fraud prevention.

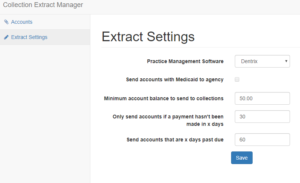

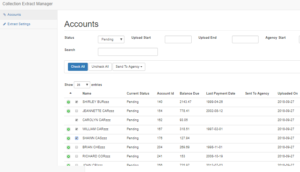

11. Integration Issues with Dental Practice Management Software:

Dental practices often rely on specialized software to manage patient records, appointments, and billing.

For example, if the practice’s scheduling software doesn’t sync correctly with its billing system, it could result in missed charges or double billing. Integration issues between this software and the accounting system can lead to discrepancies, data entry errors, and inefficiencies that the accounting staff may not be equipped to handle without significant troubleshooting.

12. Unexpected Patient Demographics:

In some cases, dental practices may experience shifts in their patient demographics (e.g., more elderly patients with Medicare or Medicaid coverage) that impact the types of services provided and the reimbursement processes.

For example, if a practice sees an influx of elderly patients, they may encounter more complex billing issues related to Medicare, which operates differently from private insurance.

13. High Patient Turnover:

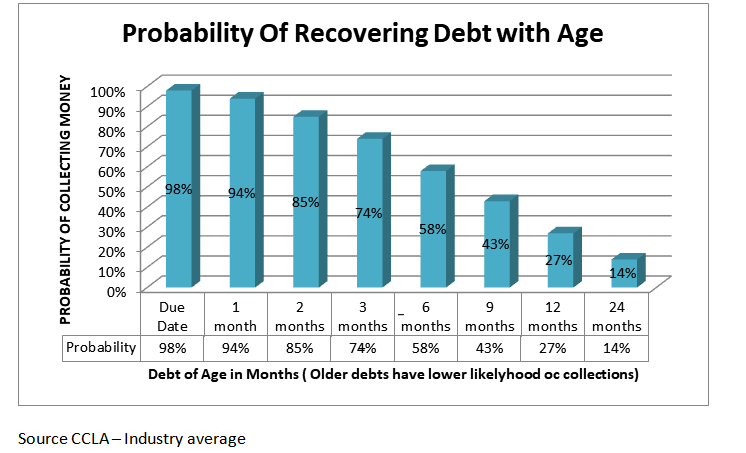

Dental practices often experience high patient turnover, particularly in areas with transient populations or in practices with aggressive new patient acquisition strategies.

For example, a practice in a college town might see a significant turnover each year as students graduate and move away. This turnover can lead to unpredictable revenue streams and create challenges in managing patient accounts, especially when dealing with unpaid balances or transferring records.

14. Equipment and Supply Depreciation and Wear and Tear:

Dental practices rely heavily on specialized equipment and supplies, which can be expensive to maintain and replace.

For example, a dental chair might break down unexpectedly, requiring a costly repair or replacement. The accounting staff may face challenges in managing the depreciation of these assets, budgeting for replacements, and handling the financial impact of unexpected equipment failures or supply shortages.

15. Fraud and Embezzlement:

Dental practices, like other small businesses, can be vulnerable to fraud and embezzlement.

For example, a staff member might manipulate the billing system to divert funds for personal use. The accounting staff may need to develop internal controls and safeguards to protect the practice’s finances and detect any potential irregularities. This might include implementing checks and balances, conducting regular audits, and monitoring financial transactions closely.

These unusual problems require accounting staff in dental practices to be adaptable, detail-oriented, and knowledgeable about the specific challenges of dental billing and financial management. Regular training, clear communication with the dental team, and a proactive approach to managing these issues can help mitigate their impact.