In the health care industry, early intervention to recover past-due bills is extremely important compared to any other industry.

But Why?

The financial situation of patients quickly deteriorates as their other medical bills are likely piling up.

It is important to recover money in the first 3-6 months before they completely lose the ability to make payments and may even resort to filing bankruptcy.

Medical practices often serve both self-pay patients and those with insurance. Our collection agency can handle the nuances of collecting from both groups, whether it involves negotiating payment from self-pay patients or resolving issues related to unpaid insurance claims.

We are a leader in medical debt collections serving hundreds of medical practices all across USA. High recovery rates.

- A dedicated team of All-American debt collectors, who specialize in collecting medical debt only.

- Treat your patients with respect and protect your reputation.

- Free “Change of Address Check” on every account submitted in case your debtor has shifted.

- Free Bankruptcy screening.

- Free litigious patient check, in case your debtor has a history of filing lawsuits on medical practices.

- HIPAA, TCPA and FDCPA complaint. Security of your data is our top priority.

- Free Credit Bureau Reporting.

- Both English and Spanish-speaking debt collectors.

- Highly rated ( Google rating 4.85 out of 5 stars. BBA rating: A+), as of October 2024.

We are Medical Collection ExpertsServing Doctors and Hospitals Nationwide: Contact us |

Serving thousands of medical practices. References available on request.

A medical debt collection agency ensures that your medical bill sits on top of other debts that the patient may owe. The collection agency will explain to your patient the consequences of not paying and pressurizes him diplomatically and amicably to pay off the bill either in full or in installments.

1. Urgency to submit medical accounts early

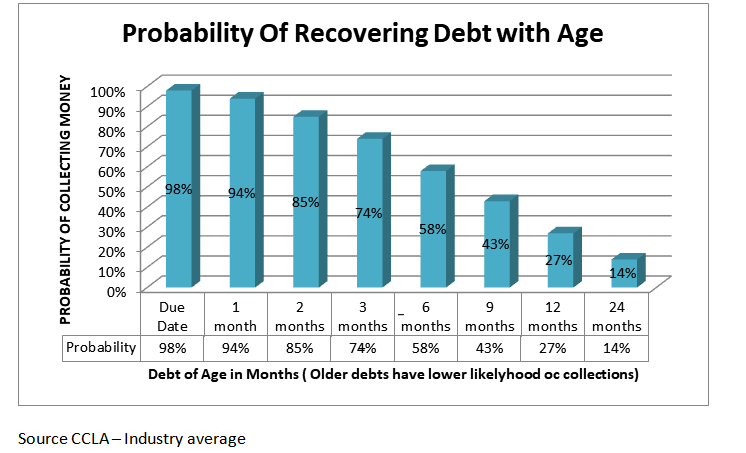

Here is a graph showing the probability of collecting money depending upon how old the debt is.

If demand is raised within 30 days, the probability of recovering money is nearly 90%. If you wait for 6 months, the chances fall to about 50% and keeps falling thereafter. Flat fees services charged by a medical debt collection agency are extremely cost-effective than engaging your own staff to handle these account receivables.

2. Keep your patients

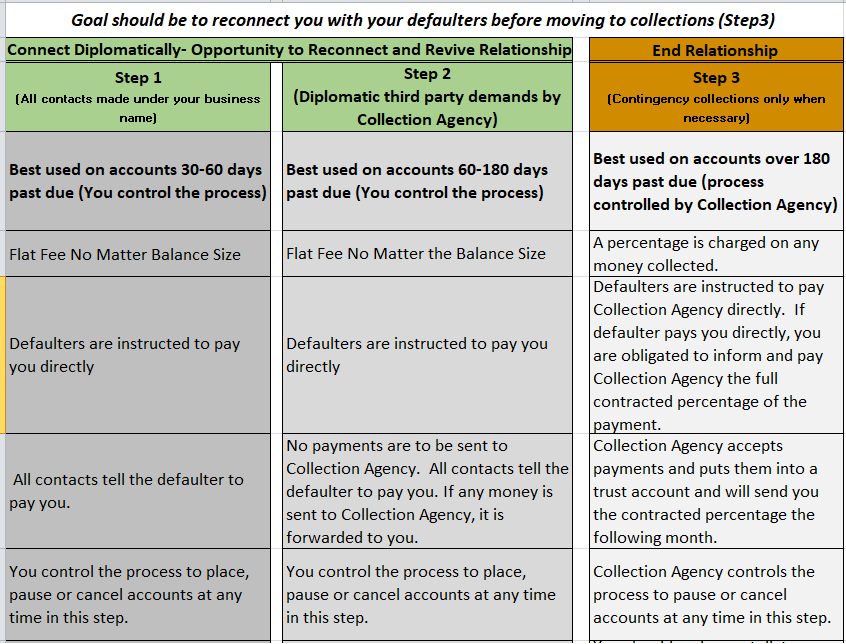

Attorney-approved Collection Letters (Step 1 or Step 2) play a vital role in medical accounts receivables. These two steps attempt to put enough pressure on the patient to pay without annoying him. Let’s look at this chart before we discuss it further.

- In Step 1, a total of five “reminder” calls/letters go out in your own name,

- In Step 2 about five more “collection” letters go out under the name of medical collection agency. In both cases, patients make payment directly to the doctor’s office.

- If a patient has not paid after sending Collection Letters, we recommend transferring the account for intensive collections ( Step 3 – Collection Calls service).

3. No one likes to pay for services

Accept the fact, people pay straight up in cash for groceries, diapers, cigarettes, alcohol, restaurant bills etc. because they are getting a physical product in exchange for money. After getting medical or dental treatment, a patient walks away with pretty much nothing. Willingness to pay for services goes down as time passes by.

How to shortlist a Medical Collection Agency

- Select an agency that does not charge extra for Address Scrub, Bankruptcy Scrub and Litigious Defaulter Scrub in its Step 1 and Step 2.

- Most agencies charge separately for Step 1 and Step 2 services. Only a few companies offer a combo package of Step 1 and Step 2, resulting in cost savings of 30% – 40%.

- Go for a medical collection agency that does both English and Spanish demands.

- Unused accounts should never expire.

- Many agencies will try to sell you contingency collection services directly (Step 3) even if your debt is less than 180 days old, which means they do not charge anything initially, but they keep about 40% to 50% of the amount collected. This is a great deal for the collection agency but not for you.

- Will the agency report your defaulters to the Credit Bureaus after all collection efforts have exhausted, and you get to set that preference.