10 out of 10 dentists recommend us!

Our HIPAA compliant patient-sensitive service is the perfect match for your practice. Our objective is to achieve a near-zero complain rate during the collections process, and protect your reputation.

We ensure that working with us is extremely simple for your dental office team.

Our persistent, diplomatic, yet a firm approach endures maximum recovery for your accounts while fully attempting to preserve your relationship with your patients.

We are Dental Collection ExpertsServing hundreds of dentists nationwide: Contact us |

Check our Google reviews (2200+ reviews, averaging 4.85 out of 5).

Not just clients but even debtors have left 5-star reviews about our collection agency due to our debt collectors’ positive and amicable attitude.

Our recovery rates are way higher than the industry average.

Dental collection agency should have a deep understanding of the dentist and patient relationship. Even with no fault of the dentist himself, a single cranky patient can attempt to spoil the reputation of a dental practitioner in many ways:

1) He may post negative reviews on Twitter, Yelp or Google

2) Spread negative publicity with word of mouth.

3) File a legal suit against the dentist for violating debt collection laws.

Dentists face ever-increasing challenges, including increased competition, changing regulatory environment and business complications. Amid all these challenges, the pressure of reduced cash flow due to non-paying past due accounts can be frustrating and a roadblock to expanding their practice.

Dental collections made simple:

Delivering enhanced collection results and improving patient experiences are the core principles of our dental debt collection solutions.

Dental Collection Services:

The Collect911 Advantage: Dental Collection Agency

a) No Expiration on Accounts: Unlike most agencies, the fixed-fee accounts purchased with us never expire, allowing you to buy in bulk at a lower price without worrying about unused accounts expiring.

b) Compliance: We strictly adhere to federal and state laws, including HIPAA, GLBA, TCPA, and FDCPA, ensuring full regulatory compliance for dental collections. We also follow all Credit Bureau Reporting laws.

c) Seamless Integration: We integrate with popular billing software like EagleSoft and Dentrix, enabling easy transfer of accounts through a simple interface, saving you time and hassle.

d) Enhanced Collection Letters: Our collection letters are printed in color, ensuring your patients take them more seriously compared to standard black-and-white notices.

e) Guaranteed Results: We guarantee collections of at least twice your purchase price if accounts are processed as per the contract or offer a refund under specific conditions.

f) 24/7 Account Access: You can submit and monitor accounts anytime via our online portal.

g) Industry Expertise: We specialize in dental collections and stay updated with regulatory changes in the field.

h) Extra Debtor Checks: We perform additional checks on debtors, including address updates, bankruptcy status, and litigation history.

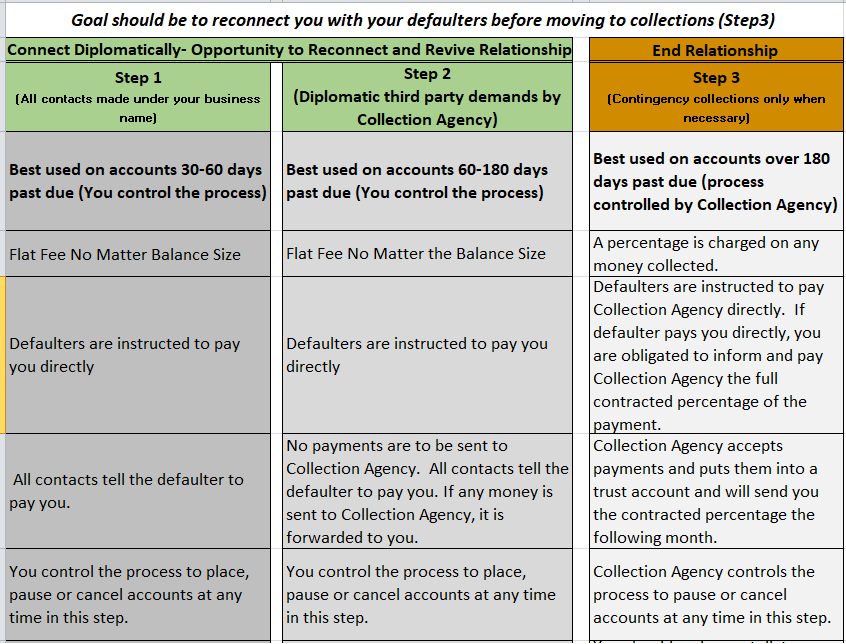

i) Contingency Services: For harder-to-collect accounts, we offer a no-recovery, no-fee contingency service for debts over 5-6 months old.

j) Transparent Pricing: Our pricing is clear with no hidden fees.

k) Cost-Effective Fixed Fees: Step 1 and Step 2 services offer a highly cost-effective way to recover past-due accounts, with a 30% discount under our combo package.

l) Credit Reporting Option: We offer to report debts to credit bureaus upon request.