Experience the Collect911 difference—a seamless, effective, and secure debt collection service that prioritizes your needs and protects your reputation.

Collect911 has helped thousands of businesses, government institutions, colleges, hospitals, dental and medical practitioners for over a decade. We are fully licensed in Florida. Being a national collection agency, we can pursue debts in all 50 states and Puerto Rico. If your debtor moved outside Florida, we can still pursue collections. We have dedicated teams to recover B2B (Commercial debt) and B2C (Consumer debt).

What distinguishes us from other collection agencies:

- We are extremely easy to use and work as per your needs (and not the other way around).

- Select between the low-cost Flat-Fee connect service (accounts never expire and debtor pays directly to you), or the traditional Contingency service.

- We understand that your business reputation is essential. As for how the debtors/patients are treated, Collect911 has one of the highest Google Ratings of all collection agencies. Over 1300 Google reviews averaging 4.8 out of 5, and 90% of reviews are from people we’ve collected money.

- There is no minimum balance requirement, no minimum number of accounts, no set-up fees, and an open-ended, non-committal customer agreement.

- Free Credit Bureau reporting.

- High recovery rates. FDCPA, HIPAA, TCPA and GLBA compliant.

- Easy to use and apart from a central customer service team, you will be assigned a dedicated Sales Rep who can be reached directly.

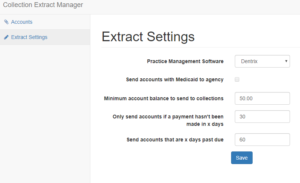

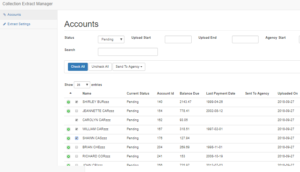

- We take security very seriously. All accounts are managed through our secure online client portal with 2-factor authentication enabled.

Our Services:

Contact us for a free consultation:

| Tell us a little bit about you |

| |

Florida Collection Laws:

Here’s an overview of some of the most important debt collection laws in Florida:- Florida Consumer Collection Practices Act (FCCPA):

- Codified in Sections 559.55-559.785 of the Florida Statutes, the FCCPA provides protections to consumers from certain abusive, deceptive, and misleading practices of debt collectors.

- The FCCPA, in many ways, mirrors the federal Fair Debt Collection Practices Act (FDCPA) but also provides protections against the original creditors, not just third-party debt collectors.

- Statute of Limitations:

- Florida law sets specific timeframes during which a creditor or collector can sue to recover a debt:

- Oral contracts: 4 years

- Written contracts: 5 years

- Promissory notes: 5 years

- Open-ended accounts (e.g., credit cards): 4 years

- Florida law sets specific timeframes during which a creditor or collector can sue to recover a debt:

- Exemptions from Garnishment:

- Florida has specific laws that protect certain income and assets from garnishment. For example, wages of a head of household are generally exempt from garnishment unless the debtor has agreed otherwise in writing.

- Florida also provides exemptions for certain types of income, such as social security, disability, workers’ compensation, and retirement pensions.

- Homestead Exemption:

- One of Florida’s most well-known protections is the homestead exemption, which generally protects an individual’s primary residence from forced sale by unsecured creditors, regardless of the home’s value.

- Communication Restrictions:

- Under the FCCPA, debt collectors are prohibited from communicating with consumers at their place of employment if the collectors have reason to know that the consumer’s employer prohibits such communication.

- Collectors are also barred from communicating with consumers at unusual hours or places, with the presumption that the hours before 8 a.m. and after 9 p.m. are unusual.

- Prohibited Practices:

- Similar to the FDCPA, the FCCPA outlines various actions deemed unlawful when collecting a debt. These include, but are not limited to, simulating a law enforcement officer or a representative of any governmental agency, using or threatening force or violence, communicating or threatening to communicate with a debtor’s employer, and disclosing information concerning the existence of a debt known to be disputed without disclosing that fact.

It’s vital for both creditors and consumers to be familiar with the FCCPA and other pertinent regulations to ensure compliance and protection of their rights.